Disclaimers

Licenses and Approvals Are Not Assured In All Jurisdictions

PALLA Protocol Labs (“Pallapay.com”) intends to operate in full compliance with applicable laws and regulations and use its best endeavors to obtain the necessary licenses and approvals. Regulatory licenses and/or approvals are likely to be required in a number of relevant jurisdictions in which relevant activities may take place. This means that the development and roll-out of all the initiatives described in this whitepaper are not guaranteed. It is not possible to guarantee, and no person makes any representations, warranties, or assurances, that any such licenses or approvals will be obtained within a particular timeframe or at all. As such, the initiatives described in this whitepaper may not be available in certain jurisdictions, or at all. This could require restructuring of these initiatives and/or their unavailability in all or certain respects. In addition, the development of any initiatives is intended to be implemented in stages. During certain stages of development, the project may rely on relationships with certain licensed third-party entities. If these entities are no longer properly licensed in the relevant jurisdiction, this will impact the ability of Pallapay.com to rely on the services of that party.

No advice

This whitepaper does not constitute any investment advice, fi nancial advice, trading advice or recommendation by Pallapay.com, its affiliates, or its respective offi cers, directors, managers, employees, agents, advisors or consultants on the merits of purchasing PALLA tokens nor should it be relied upon in connection with any other contract or purchasing decision.

Not a sale of the security

This whitepaper does not constitute a prospectus or financial service offering document and is not an offer to sell or solicitation of an offer to buy any security, investment products, regulated products or financial instruments in any jurisdiction. PALLA tokens are not being structured or sold as securities in Pallapay.com. Owners of PALLA tokens are not entitled to any rights in Pallapay. com or any of its affiliates, including any equity, shares, units, royalties to capital, profit, returns or income in Pallapay.com or any other company or intellectual property associated with Pallapay.com.

No representations

No representations or warranties have been made to the recipient of this whitepaper or its advisers as to the accuracy or completeness of the information, statements, opinions or matters (express or implied) arising out of, contained in or derived from this whitepaper or any omission from this document or of any other written or oral information or opinions provided now or in the future to any interested party or their advisers. The PALLA tokens, as envisaged in this whitepaper, are under development and are being constantly updated, including but not limited to key governance and technical features. If and when the PALLA tokens are completed, they may differ significantly from the description set out in this whitepaper. No representation or warranty is given as to the achievement or reasonableness of any plans, future projections or prospects and nothing in this document is or should be relied upon as a promise or representation as to the future. To the fullest extent possible, all liability for any loss or damage of whatsoever kind (whether foreseeable or not and whether or not Pallapay.com has been advised of the possibility of such loss or damage) which may arise from any person acting on any information and opinions contained in this whitepaper or any information which is made available in connection with any further enquiries, notwithstanding any negligence, default or lack of care, is disclaimed.

Third party data

This whitepaper contains data and references obtained from third party sources. Whilst the management believes that these data are accurate and reliable, they have not been subject to independent audit, verification, or analysis by any professional legal, accounting, engineering, or financial advisors. There is no assurance as to the accuracy, reliability or completeness of the data.

Translations

This whitepaper and related materials are issued in English. Any translation is for reference purposes only and is not certified by any person. No assurance can be made as to the accuracy and completeness of any translations. If there is any inconsistency between a translation and the English version of this whitepaper, the English version shall prevail.

Restricted transmission

This whitepaper must not be taken or transmitted to any jurisdiction where distribution or dissemination of this whitepaper is prohibited or restricted.

Views of Pallapay.com

The views and opinions expressed in this whitepaper are those of Pallapay.com and do not reflect the official policy or position of any government, quasi-government, authority or public body (including but not limited to any regulatory body) in any jurisdiction. This whitepaper has not been reviewed by any regulatory authority.

Third party references

References in this whitepaper to specific companies, networks and/or potential use cases are for illustrative purposes only. The use of any company and/or platform names and trademarks does not imply any affiliation with, or recommendation or endorsement of/by, any of those parties.

All references to ‘dollars’, USD or ‘$’ are references to the United States Dollars unless otherwise stated.

Graphics

All graphics included in this whitepaper are for illustrative purposes only. In particular, graphics with price references do not translate into actual pricing information.

Risk statements

Purchasing PALLA tokens involves substantial risk and may lead to a loss of a substantial or entire amount of the money involved. Prior to purchasing PALLA tokens, you should carefully assess and take into account the risks, including those listed in any other documentation.

A purchaser should not purchase PALLA tokens for speculative or investment purposes. Purchasers should only purchase PALLA tokens if they fully understand the nature of the PALLA tokens and accept the risks inherent to the PALLA tokens.

Cryptographic tokens may be subject to expropriation and/or theft; hackers or other malicious groups or organizations may attempt to interfere with our system/network in various ways, including malware attacks, denial of service attacks, consensus-based attacks, Sybil attacks, smurfing, and spoofing which may result in the loss of your cryptographic tokens or the loss of your ability to access or control your cryptographic tokens. In such event, there may be no remedy, and holders of cryptographic tokens are not guaranteed any remedy, refund, or compensation.

The regulatory status of cryptographic tokens and digital assets is currently unsettled, varies among jurisdictions and subject to significant uncertainty. It is possible that in the future, certain laws, regulations, policies or rules relating to cryptographic tokens, digital assets, blockchain technology, or blockchain applications may be implemented which may directly or indirectly affect or restrict cryptographic token holders’ right to acquire, own, hold, sell, convert, trade, or use cryptographic tokens.

The uncertainty in tax legislation relating to cryptographic tokens and digital assets may expose cryptographic token holders to tax consequences associated with the use or trading of cryptographic token.

Digital assets and related products and services carry significant risks. Potential purchasers should take into account all of the above and assess the nature of, and their own appetite for, relevant risks independently and consult their advisers before making any decisions.

Professional advice

You should consult a lawyer, accountant, tax professional and/or any other professional advisors as necessary prior to determining whether to purchase PALLA tokens.

Caution Regarding Forward-Looking Statements

This whitepaper contains certain forward- looking statements regarding the business we operate that are based on the belief of Pallapay. com as well as certain assumptions made by and information available to Pallapay.com. Forward-looking statements, by their nature, are subject to significant risks and uncertainties.

Forward-looking statements may involve estimates and assumptions and are subject to risks, uncertainties and other factors beyond our control and prediction. Accordingly, these factors could cause actual results or outcomes that differ materially from those expressed in the forward-looking statements.

Any forward-looking statement speaks only as of the date of which such statement is made, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events.

Introduction

Pallapay is the only payments solution in UAE which allows businesses to accept, process and disburse CRYPTO payments with its product suite, being one of the leading payment service providers in the Gulf and Middle East region and is registered as a Payment Service Provider in UAE. Pallapay is a service that enables you to pay, send money, and accept payments. Pallapay is a payment services provider and acts as such by creating, hosting, maintaining and providing our Pallapay Services to you via the Internet. Our services allow you to send payments to anyone with a Pallapay Account, and, where available, to receive payments. Our service availability varies by country.

A Brief Review of Pallapay

Introducing Technical Developers:

Human resources is the key element of success for any company. knowing so, we have employed some of the world’s best technical developers to run the project. Palla gives a huge amount of attention to its human capital and always tries to use the best ones in the field.

If you have any question about technical details or any relevant Management issues, do not hesitate to contact us at our head quarter in UAE:

HEADQUARTERS:

MANAGEMENT AND SALES TEAM

OFFICE P402 BINARY BY OMNIYAT, BUSINESS BAY,

DUBAI, UAE

TEL: +971-4-426-4781

E-mail: [email protected]

TECHNICAL DEPARTMENT:

CUSTOMER SERVICES & OPERATIONAL TEAM

OFFICE 626 BUSINESS VILLAGE BLOCK B, DEIRA, DUBAI, UAE

COMPLIANCE DEPARTMENT:

17801 MAIN STREET, IRVINE, CALIFORNIA, USAAdvances Made So Far:

Pallapay has Obtained PSP license in emirate of Dubai, UAE.

Pallapay is proud to be the first company to exchange digital currencies to fiats and vice versa with a license from the UAE government.

With the design and development of online payment services, the second stage of making payment easier for companies and individuals and Also commercial payment services to e-commerce services was provided.

We Design and develop an online wallet system and add it to pallapay.com for users to send and receive money easily and also, add local and international money transfer facilities with AED, USD, EUR, and GBP.

Mission & Vision:

Accelerate the World’s Transition to Cryptocurrency. We believe that by accelerating the transition to adopting cryptocurrency, we can help people globally to:

Control Their Money - Ability to access their funds anytime and anywhere;

Safeguard Their Data - Cryptography-secured blockchain makes data-tempering highly unlikely;

Protect Their Identity - No central entity can compromise your identity.

Our vision is to source the world’s best E/M-commerce capabilities for our clients, delivered with local knowledge and support. To deliver this vision, Pallapay Ltd. has developed “PallaPay.com” (“PallaPay”) to provide a sophisticated gateway and fraud solution to market. PallaPay is MENA’s most innovative payment gateway with greater security of payments, simple refund capability, and easier checkout. With PallaPay.com you can accept the payment types preferred in local markets, transact payments in over 140 countries, and fund in 20 currencies, all through a single connection.

ROAD MAP

Since our founding, we have achieved the following milestones thanks to the support of our community:

-

1. Obtaining PSP license (Pallapay Ltd.) in Emirate of Dubai, UAE. (2017)

Pallapay is proud to be the first company to exchange digital currencies to fiats and vice versa with a license from the payment easier for companies and individuals and Also commercial payment services to e-commerce services was provided.

-

2. Start of design and development of online payment services (Pallapay.com) (2017)

-

3. Agreements with banks to facilitate payments and becoming the aggregator for, MasterCard, American Express, etc. (2018)

American Express and MasterCard define a payment facilitator as a provider of payment services that accept the MasterCard and American Express Card as the merchant of record on behalf of sponsored merchants. As a payment facilitator, we have a relationship with the sponsored merchants and receive settlement on behalf of your sponsored merchants.

-

4. Official launch of Pallapay.com and start of commercial payment services to e-commerce services. (2018)

-

5. Design and development of online wallet system and adding it to Pallapay.com for users to send and receive money. (similar to PayPal and Skrill) (2018)

-

6. Design and development of escrow payment protection system and integrating it into pallapay.com. (2018)

Economic crimes are rising across the world, creating challenges in the current payment ecosystem. Nearly half (47%) of the businesses responding to a crime study reported being a victim of fraud, with the total reported losses by respondents reaching $42 billion.

-

7. Adding local and international money transfer facilities with AED, USD, EUR, and GBP. (2018)

-

8. Design and development of checkout plugin for most famous e-commerce platforms such as woocommerce, magento, prestoshop, etc. (2019)

-

9. Design and development of online invoicing system for users to be able to generate and send invoices for payments where payers can pay choosing from more than 100 payment methods. (2019)

-

10. Onboarding key clients in UAE and facilitating their e-commerce. (2019)

-

11. Design and development of Pallapay Link, where users can have their own social page and receive payments. (2019)

-

12. Issuing virtual and physical prepaid MasterCard for users by which they can use their Pallapay available balance. (2019)

A prepaid debit card is an alternative banking product that only lets you spend the money you load onto the card. Like debit cards, prepaid cards work at any merchant that accepts its payment network, such as Visa or Mastercard. They’re safer and more convenient than using cash. Pallapay Prepaid Cards Avail instantly-approved prepaid cards for your business to manage and track expenses.

-

13. Providing payment services to unregistered businesses and freelancers. (2020)

-

14. Collaboration with UnionPay with agreements and contracts made for Pallapay to be the sole acquirer of UnionPay in UAE with possibility to expand to GCC. (2020)

-

15. UnionPay card payment option added to Pallapay. com. (2020)

As a new option, UnionPay card payment has been added to pallapay.com and Pallapay becomes the UnionPay Acquirer.

-

16. Adding cryptocurrency payment gateway for cryptocurrency to fiat for the first time in Middle East. (2020)

The First And Only Crypto Payment Gateway to Fiat in UAE and MiddleEast

We have added most of cryptocurrency’s as a payment to pallapay payment gateway

-

17. Ability to charge Pallapay Mastercard Prepaid card via Crypto added to Pallapay. (2020)

-

18. First official cryptocurrency OTC exchange started in UAE. (2020)

-

19. Onboarding semi- governmental companies to accept crypto as payment for the first time in Middle East, using Pallapay. (2021)

-

20. Build and development of Pallapay TRC20 Token (PALLA). (2021)

-

21. Design and development of decentralized wallet APP where users can buy, sell and exchange their crypto to crypto, crypto to fiat and fiat to crypto. (2021)

-

22. Design and development of centralized APP where users can store, buy, sell and exchange their crypto to crypto, crypto to fiat and fiat to crypto. (2021)

-

23. Launching professional trading platform. (Future)

-

24. Designig, developing and manufacturing cryptocurrency ATM machines for buying and selling cryptocurrency. (Future)

-

25. Design and development of crypto loan program where clients can stake their crypto assets and get fiat loan with APR. (Future)

-

26. Obtaining EMI and banking license in Lithuania. (Future)

-

27. Designing, developing and manufacturing portable cryptocurrency POS machines for retail businesses around the world, with fiat settlement. (Future)

Solutions Overview

Below is an overview of the products we offer along three verticals:

- Payment - Pallapay.com, MasterCard, UnionPay Card

- Trading - Pallapay.com, Pallapay.com Exchange

- Financial Services - Decentralized Finance Products, Crypto Earn.

Pallapay Token (PALLA) will power all of our products and offer rich token utility for different use cases (see section on Token Utility below).

Pallapay is bringing a new user experience to the global marketplace by proposing a decentralized system built on Tron that focuses on blockchain functionalities for the next generation of payments processing.

- Escrow Service Too

- Multi-currency payment processing (wrapped assets)

- Milestone payments

- Marketplace

- Governance system

- Open API for online marketplaces, service providers, and e-commerce platforms.

- Credit/Debit Cards

- Digital Wallet

- Bank Accounts & Stored Balance

- Loyalty & Rewards

- Coupons & Offers

- Gift Cards

Mastercard and UnionPay Card

Value Proposition

Customers typically face the following pain points when trying to buy & spend with cryptocurrencies:

- Lack of places to transact with crypto;

- Having to endure long lead times (3-4 days) for processing;

- Being charged significant FX fees (up to 5% of purchase amount) by financial institutions when spending abroad with regular fiat debit or credit cards.

The Mastercard or UnionPay Card addresses these pain points by allowing cardholders to:

- A. Transact without annual fees at 60+ millions Mastercard merchant locations worldwide;

- B. Enjoy instant top-up and payment completion without waiting time;

- C. Spend overseas at interbank exchange rates without markups;

- D. Benefit from amazing perks associated with the card.

User Experience

The Mastercard or UnionPay Card offers benefits that challenge the world’s best credit cards. Users can apply for different tiers of Mastercard or UnionPay Card that offer different perks.

From 20 July 2021, PALLA Staking is Required for the

- Pallapay.com Mastercard or UnionPay Card,

- Payment Gateway,

- Money Transfer,

- OTC

- Branch Services etc…

Pallapay.com Solutions - Trading

Pallapay.com App Value Proposition

Pallapay.com App delivers the following value propositions:

- One-stop shop to buy, sell, store, send & track cryptocurrency in a secure and convenient way with a few taps on your mobile phones;

- The only place to buy crypto at true cost - Pallapay.com’s proprietary Vortex Trading Engine pools liquidity from major exchanges globally and routes orders to them to ensure the Best Execution Price. Coupled with our increasing coverage of fiat top-up channels and convenient app interface, this makes Pallapay.com App the best place to buy crypto.

Special promotion: The 4.5% credit/debit card fee will be waived for cryptocurrency purchases for all users until the end of September.

Metrics available include prices, volume, market cap, % change and more that are refreshed frequently and up-to-date. The app also presents charts in dual currencies (USD, BTC) and different time frames (8H, 1D, 1W, 3M, 6M).

Manage the Mastercard or UnionPay Card

The Pallapay.com App enables users to apply for and manage their Mastercard or UnionPay Card and enable spending of their cryptocurrency in the online and offline world at more than 40 million Mastercard merchants worldwide. Supported app functions include:

Convert cryptocurrency into fiat ready for spending (including AED, USD, EUR, GBP)

Enable card withdrawal, freeze/ unfreeze the card

Upgrade card tier etc.

User Experience

Buy & Sell Crypto

Users can buy crypto with their fiat wallets and/ or with a credit or debit card. The Pallapay.com App supports 5 fiats and 855 cryptocurrencies.

Send Crypto

Users can send crypto to Pallapay.com App instantly without fees, or withdraw crypto to external wallet addresses with minimal fixed fees.

Track Crypto

Users can monitor 200+ coins at their fingertips in the coin tracking tab.

Pallapay.com Exchange

Value Proposition

Pallapay.com Exchange lets users trade crypto at ease with the following value propositions:

- Deep liquidity with access to the best execution prices;

- Competitive fees offered with high volume accounts trading for free

(after PALLA staking discount); - Engaging events provided, such as discounted token distributions (Syndicate) and trading activity-driven competitions (Trading Arena);

- Institutional-grade infrastructure that powers high-availability, fullyresilient and horizontally scalable components.

Pallapay.com Exchange debuted with the spot trading functionality, with more features & promotions being added to the platform to deliver a suite of trading-related services for retail & corporate users alike.

Furthermore, Pallapay.com Exchange helps to facilitate PALLA liquidity with PALLA trading pairs and PALLA-related activities.

Pallapay.com Decentralized Swap

Decentralized Swap is designed to be the best place to swap and farm Decentralized coins at the best available rate, leveraging proven and audited protocols, while offering an outstanding incentive program powered by PALLA.

Liquidity Providers (LPs) are generously incentivized for contributing to liquidity pools with Triple Yield through:

Swap-fee Sharing for LPs;

PALLA Decentralized Yield for LPs who also stake PALLA; Bonus LP Yield for LPs of selected pools.

Decentralized Swap follows a constant product formula, where the product of the quantities of two tokens remain the same before and after a swap is performed. The price slippage depends on the ratio and quantity of tokens in the pool.

The Decentralized Swap is a decentralized protocol deployed on the Ethereum blockchain. Each transaction record such as on-chain deposits and withdrawals are transparent on the network. The role of Pallapay.com is as a provider of technology by contributing to the development of the product. Pallapay. com is open-sourcing the core codebase and welcomes the input and decentralized contributions from the community.

Decentralized swap is integrated with the Decentralized wallet allowing users to exchange tokens directly in the Decentralized Wallet app.

Pallapay.com Solutions - Financial Services

Decentralized Financial Services Pallapay.com

Decentralized Wallet

Value Proposition

To take one more step towards letting users better safeguard their money, data and identity, we have launched the Pallapay.com Decentralized Wallet, which is a non-custodial wallet app that allows users to gain full ownership of their private keys.

Pallapay.com Decentralized Wallet offers the following value propositions:

- A Decentralized product giving users full control of private keys (and crypto) are placed in the hands of users;

- Secure wallet protected by the encryption of private keys on the user’s device, combined with passcode, biometrics and 2-factor authentication;

- Flexible transactions with customizable confirmation speed and network fees;

- Convenient connection to the Pallapay. com App to easily access the diverse crypto financial services offered by Pallapay.com.

Centralized Financial Services

- PAYMENT GATEWAY

- E-WALLET

- MOBILE PAYMENT

- VOUCHERS & GIFT CARDS

- ESCROW TRANSACTION

- LOYALTY & REWARDS

- OUR BENEFITS

- YOUR FINANCIAL INFORMATION

We help keep your transactions secure by not sharing your full financial information with sellers.

ALL IN ONE PAYMENT

Pay With PayPal, Visa, Master Card, American Express, Bank Transfer, All in One Place.

FRAUD PREVENTION

Contact us if anything seems suspicious so we can help you protect yourself from fraudulent charges against your account.

PURCHASE SECURITY

We will refund your money if after payment you do not receive the declared goods/service.

DISPUTE RESOLUTION

If there is a problem with a transaction, we will put a hold on the funds until the issue is resolved. We investigate and stay involved every step of the way.

OUR CERTIFICATIONS

PAYMENTS ARE SECURED WITH US

From all the payment gateway services that Pallapay provides, security is the most crucial one. Being PCI-DSS certified and armed with 3D secure authentication and a dual-layer fraud protection system, Pallapay makes transactions 100% safe. Customer data and transaction history are protected securely to prevent identity theft, phishing, and other forms of online fraud.

PALLA TOKEN

Token Creation and Basic Information

PALLA Token Has Been Created on Tron Network on May, 2021

Why TRON Network

Tron is a blockchain-based decentralized platform that aims to build a free, global digital content entertainment system with distributed storage technology, and allows easy and cost- effective sharing of digital content. TRON is one of the largest blockchain-based operating systems in the world with this unique feature:

- High throughput is achieved by improving the TPS in TRON, which has surpassed Bitcoin and Ethereum, to a daily-use practical degree

- Applications are given a wider variety of ways to be deployed in TRON because of its scalability and highly effective smart contract. It can support enormous numbers of users.

- More reliable network structure, user asset, intrinsic value, and a higher degree of decentralization consensus come with an improved rewards distribution mechanism.

- High transfer speed, low transactions fees (almost zero), great network development plans.

Technologies Used In PALLA

the production of Palla is not limited and the purpose of creating it is to use it permanently in transactions. So, although according to

the explanations provided below, its trend is constantly upward in the long run, it never loses the nature of being an intermediary of exchange.

| Name | Pallapay |

| Symbol | PALLA |

| MintDest | TT1HSXMuyUUyK9qyH8n8UB3PdYBHtvEVQG |

| intAccessor | TUpm2LSeLiTCRtiwMrWPF7okNFvEZRBL3R |

| Official Website | www.pallapay.com |

| Total Supply | 2,000,000,000 |

| Circulating Supply | 2,000,000,000 |

| Max Supply | 10,000,000,000 |

| Infelation rate | 2.76 |

| decimals | 8 |

What Makes PALLA Distinct?

Pallapay Company is currently providing services to private and public companies from 2018, and the issuance of Palla Token is just a step towards providing better services to customers.

Palla is one of the few tokens created by a well- known payment company after going through many legal steps and creating a valuable token with the help of highly qualified experts and consultants in the United Arab Emirates. The purpose of creating this token is to organize payment and settlement systems in the Palla network. The main applications of the token include the following:

-

Valid token for transactions and purchases and small or large payments

The total amount of tokens produced will be 10 Billion, 80% of which will be initially offered through five-years: from 2021 up to 2025, and 10% of which will be for the development and advertising team. 10% will be in exchanges at a price of $0.05. What distinguishes Palla Token is its annual inflation rate of 2.76%. According to our research, although one of the goals of creating Bitcoin is to prevent the permanent devaluation of money and to take control and bypass interference of governments, but it was not noticed that gold was gradually removed from trades with economic growth and development of countries and was a backup for fiat in short time and then, as a boon to global development, only known as an asset and removed from world trades because of variety of reasons, including high transaction costs.

TIME VOLUME PERCENTAGE OF DISTRIBUTION ICO & Exchange Off ering: 2021 ICO & AirDrops: 2,000,000,000

Exchange: 1,000,000,00030% Year: 2022 2,000,000,000 20% Year: 2023 1,800,000,000 18% Year: 2024 1,500,000,000 15% Year: 2025 700,000,000 8% Reducing the cost of transactions and payments

A valid token to deposit and also to provide various services, including the issuance of prepaid cards

Providing banking services using this token, such as receiving loans, making deposits, etc.

What we learn from these charts is that on average, people in the past were many times poorer than we are today. In 1820 the global GDP per capita is estimated to have been around 1,102 international-$ per year and this is already after some world regions had achieved some economic growth. For all the hundreds, and really thousands, of years before 1820, the average GDP per capita was even lower. Therefore, the demand for all goods and services, including currency, is constantly increasing over time. Therefore, it is necessary to have enough supply to meet the demand for Bitcoin, which due to its nature, will be constantly increasing in value.

With economic growth, Bitcoin price will also be higher, and in practice, it’s the best option for storing the purchasing power and will be better than gold and many bonds and funds. Bitcoin takes its credit from the people, unlike fiats and bonds that they take it from governments. On the other hand, human beings are interested in the constant prices of goods and services that they buy or sell and in order to plan for their financial goals, whether individually or as a company, without serious risks and severe fluctuations. Developed countries have succeeded to control the inflation rate in practice, but financial crisis are causing serious changes that cast doubt on the ability of governments to stabilize their currency, and there is a risk that it will occur in the future, as we have seen in past decades, There have been severe fluctuations.

So, what is the solution? How can we create a money that is value-storing and transaction- medium at the same time? Or at least, a money that is a transaction medium without losing its value.

Our research shows that it is necessary to control both the supply and demand of currency and to add a permanent and average amount to currency , in order to meet the demand ,to stabilize prices, and to prevent the currency to be an asset.

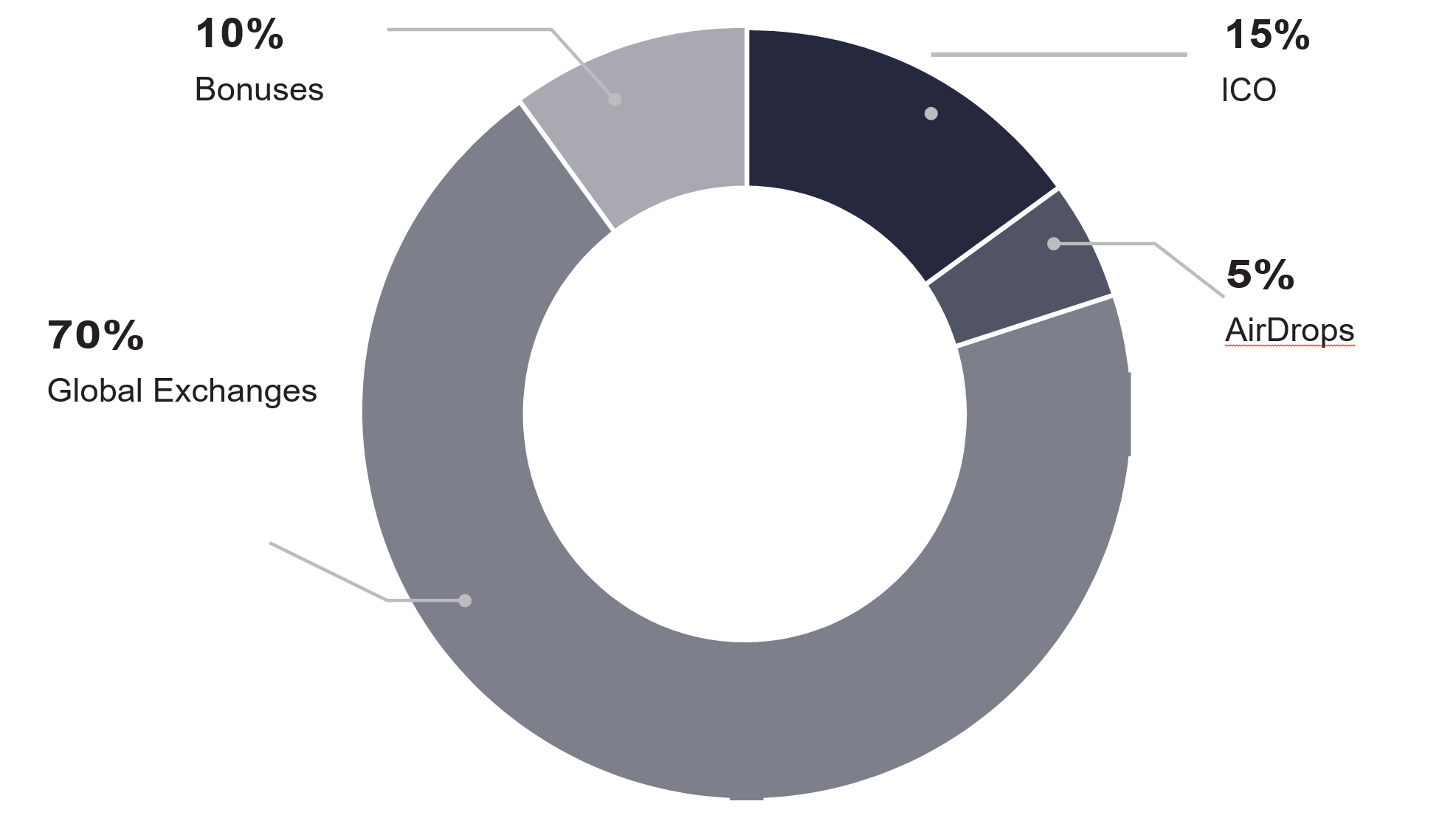

How PALLA Is Distributed?

The total amount of distribution of Palla Token will be 10 billion, of which only 15% will be offered by ICO in 4 weeks and 5% for airdrops and bonuses. 10% will be offered for sale in best global exchanges. 70% of the tokens are generated, which will be explained in the next section and will be in the market through 5 years.

for the developers to develop, for the adverting team to promote the token and meet the execution cost, 10 % would remain. developers have no permission to sell more than 2% of their share per annum.

In addition, 2.76% per annum will be added to the volume of tokens available in the market.

Initial Coin Offering (ICO)

The supply of Palla Token will be done in two stages: 1.5 billion on the official site (pallapay. com) for one month in four-stages, the first week will be priced at $0.04, the second week at $0.05, the third week at $0.06 and the fourth week at $0.07. In the first and second week, each week 300 million tokens, in the third week 400 million tokens and in fourth week 500 million tokens will be issued. If there is more demand each week, the token supply will increase by 10% in that week. After that, the remaining amount of 2.5 billion tokens will be offered in Exchanges and after that, tokens will be produced only according to the needs of the market.

The first token offering at Exchanges will be up to a maximum of 1 billion tokens priced at $0.08. If more than 1.5 billion tokens are sold in the ICO stage it will be deducted from the 2.5 billion. The purpose of selling ICO tokens is to expand services and build community and liquidity to develop upcoming projects.

| weeks | price | amount |

|---|---|---|

| 1st week | $0.04 | 24 Million Up To 300 Million |

| 2nd week | $0.05 | 300 Million Up To 330 Million |

| 3rd week | $0.06 | 400 Million Up To 440 Million |

| 4th week | $0.07 | 500 Million Up To 550 Million |

| Exchange Offering | $0.08 | 1 Billion |

AirDrop, BOT, Bonus

An AirDrop, in the cryptocurrency business, is a marketing stunt that involves sending coins or tokens to wallet addresses in order to promote awareness of a new virtual currency. Small amounts of the new virtual currency are sent to the wallets of active members of the blockchain community for free or in return for a small service, such as retweeting a post sent by the company issuing the currency.

To participate in AirDrops, be sure to pay attention to the following:

- Be sure to have a Tron wallet, we recommend Tron Link Pro

- Use the same email to register different sections

- Create an account on Telegram and Twitter

- Create an account on Pallapay.com

Information about AirDrops is given only through the official website and official media of Pallapay Company. Be cautious of scammers and similar tokens.

The first stage of AirDrop is before the first public coin offering. 5 million tokens will be distributed among the initial registrant wallets on the official site. Another 5 million will be distributed randomly among many wallets after registration in an exchange.

With the beginning of each stage of the initial coin offering, 5 million tokens will be airdropped among ICO buyers (20 million in total) so that according to the sales volume per week, and according to the percentage of purchases of each person, the same percentage of 5 million tokens will be sent to that person.

50 million tokens will be transferred to the mining robot and will be given as a bonus after the required tasks and missions among the participants are done. This part is executed after the token listing on an exchange. Another 4 million tokens will be dedicated to challenges on official media of Pallapay and lucky draws among the followers of the social media pages.

100 million tokens to set up a system for introducing and bringing new members in different sections of Pallapay, such as decentralized wallet, registering on the website, Palla social media and new memberships.

Future Plans

Launching Professional Trading Platform

A trading platform is a software used for trading: opening, closing, and managing market positions through a financial intermediary such as an online broker. Online trading platforms are frequently offered by brokers either for free or at a discounted rate in exchange for maintaining a funded account and/or making a specified number of trades per month. A trading platform enables investors and traders to place trades and monitor accounts through financial intermediaries. Oftentimes, trading platforms will come bundled with other features, such as real-time quotes, charting tools, news feeds, and even premium research. Platforms may also be specifically tailored to specific markets, such as stocks, currencies, options, or futures markets. Platforms range from basic order entry screens for beginner investors to complex and sophisticated toolkits with live streaming quotes and charts for advanced traders.Traders and investors should take multiple considerations into account and balance trade-offs when selecting a trading platform.

Pallapay as one of the best trading platforms, will offer a mix of robust features and low fees. Pallapay intends to meet all the needs of traders by providing an advanced and reliable platform and by providing more options to be one of the best trading platforms in the market. Pallapay team is working constanly on the ideas of creating one of the best trading platforms. We are studying most of the platforms out there, taking into consideration all of their features and abilities, their advantages and disadvantages and reviewing the feedbacks from users and our technical team. All these informations and data will be gathered, analyzed and carefully studie, in order to bring you a safe, complex and complete platform,yet simple, easy to use and user friendly.

Cryptocurrency ATM Machines and POS Machines

Designing, developing and manufacturing portable cryptocurrency POS machines for retail businesses around the world, with fiat settlement buy groceries and pay with your cryptocurrency using crypto POS machines. Pallapay is bringing this to the Emirate of Dubai and UAE, and soon all over the world. Palla is one of the largest manufacturer of POS and ATM machines that is seriously working to achieve this goal and is currently in talks with a chain store around the world. The results are very optimistic.

From now on, you can easily go to crypto ATM and enter your digital currency and easily receive Fiat, or buy your coffee before work with crypto POS machine at the lowest transaction cost (close to zero). With ongoing negotiations, most of the stores and shopping centers in the UAE will be equipped with crypto ATM machines & POS payment gateways.

Design and Development of Crypto Loan Program

When investing, one of the biggest challenges can be cashflow — and there is nothing worse than having to raid the capital you have got tied up in assets for short-term costs and lack of liquidity. In short, crypto loan is an alternative investment form, where investors lend fiat money or cryptocurrencies to other borrowers in exchange for interest payments. There would be two main parties involved in this loan. The lender and the burrower. The lender will receive interest from the borrower in exchange for the loan. One of the benefits of investing in cryptocurrency is the ability to use your crypto holdings as collateral for a loan, even if your holdings are relatively small. Crypto loans are much more accessible, and they offer “hodl” investors a way to achieve liquidity from their investment without selling it. Pallapay intends to make it possible for clients to stake their crypto assets and get fiat loan with APR, also creating different methods of borrowing and depositing for customers

Obtaining EMI and banking license in European Union.

Electronic money (e-money) institution (or EMI) is a licensed financial institution which may engage in e-money related services and payment services EMI Institution allows provision of all payment services in much wider range comparing with Payment Institution designed for instant payment processing. EMI can hold client funds for the unlimited period of timed in opened individual client IBAN accounts ,The full license for e-money is not limited in either time or area of activities. Thus, a holder of the e-money institution license in Lithuania shall be allowed to provide any services in the European Economic Area (EEA) without having to undergo a licensing procedure in any other member state. After the license in Lithuania is obtained the e-money institution may provide services in other EEA member states by establishing branches or by means of pass porting (with the use of freedom to provide services)